wikistreets.ru

Learn

2021 Us Income Tax Brackets

Depending on your income and filing status, there are 7 IRS tax brackets for the Tax Year: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. In the United States, your taxable income is not taxed at a single fixed rate. Instead, it is divided into different tax brackets, each with its own tax. Use the EITC tables to look up maximum credit amounts by tax year. If you are unsure if you can claim the EITC, use the EITC Qualification Assistant. Individual Income Tax rates range from 0% to a top rate of 7% on taxable income for tax years and prior, from 0% to a top rate of % on taxable income. IRS Tax Rate Schedules. Your federal tax rates are based on your income level and filing status. The percentages and income brackets can change annually. For Tax Years , , and the North Carolina individual income tax rate is % (). About Us · Contact Us. Contact Information. North. Thanks for visiting the tax center. Below you will find the tax rates and income brackets. ; $,, $,, $67,+ 32%, $, ; $,, $, Tax Information for Individual Income Tax. For tax year , Maryland's personal tax rates begin at 2% on the first $ of taxable income and increase up to. Federal Tax Brackets ; (, 70, minus, 17,), x 7, ; (, , minus, 70,), x 7, ; Total: $ 17, Depending on your income and filing status, there are 7 IRS tax brackets for the Tax Year: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. In the United States, your taxable income is not taxed at a single fixed rate. Instead, it is divided into different tax brackets, each with its own tax. Use the EITC tables to look up maximum credit amounts by tax year. If you are unsure if you can claim the EITC, use the EITC Qualification Assistant. Individual Income Tax rates range from 0% to a top rate of 7% on taxable income for tax years and prior, from 0% to a top rate of % on taxable income. IRS Tax Rate Schedules. Your federal tax rates are based on your income level and filing status. The percentages and income brackets can change annually. For Tax Years , , and the North Carolina individual income tax rate is % (). About Us · Contact Us. Contact Information. North. Thanks for visiting the tax center. Below you will find the tax rates and income brackets. ; $,, $,, $67,+ 32%, $, ; $,, $, Tax Information for Individual Income Tax. For tax year , Maryland's personal tax rates begin at 2% on the first $ of taxable income and increase up to. Federal Tax Brackets ; (, 70, minus, 17,), x 7, ; (, , minus, 70,), x 7, ; Total: $ 17,

Since , the income tax share of the bottom half of earners has fallen from 7 percent to percent in (compared to percent last year). Year The U.S. federal income tax system is progressive. This means that income is taxed in layers, with a higher tax rate applied to each layer. Below. United States (tax year and forward). Please note: An Arizona full-year resident is subject to tax on all income, including earnings from another state. If you are a Nonresidents, including foreign nationals and persons who reside in states that do not have income taxes, must file here when they have a federal. tax brackets and federal income tax rates ; 10%, $0 to $9,, $0 to $19, ; 12%, $9, to $40,, $19, to $81, ; 22%, $40, to $86,, $81, Marginal Tax Brackets ; 10%, $0 to $9,, $0 to $19, ; 12%, $9, to $40,, $19, to $81, ; 22%, $40, to $86,, $81, to $, ; 24%. The average taxpayer in the United States paid $13, in federal income taxes in How does that compare to where you live? ; Connecticut, $20,, +$7, As of , there are currently seven federal tax brackets in the United States, ranging from 10% to 37%. Single filers for tax year who have less than. Marginal Tax Brackets ; 12%, $9, to $40,, $19, to $81, ; 22%, $40, to $86,, $81, to $, ; 24%, $86, to $,, $, to. In , there are seven federal tax brackets: 10%, 12%, 22%, 24%, 32%, 35% and 37%. The bracket depends on taxable income and filing status. Tax Brackets & Rates ; , , ; 10%, 0 – $9,, 10%, 0 – $9,, 10%. Marginal tax rates and income brackets for Marginal tax rate, Single taxable income, Married filing jointly or qualified widow(er) taxable income. Earned income — income you receive from your job(s) — is measured against seven tax brackets: 10%, 12%, 22%, 24%, 32%, 35% and 37%. Income. Deductions and Credits. Tell us about yourself. How will you be filing your tax return? Single Married Filing Jointly Married Filing Separately Head of. wikistreets.ru - Canada's Federal & Personal income tax brackets and tax rates for for eligible and non-eligible dividends, capital gains. For each bracket, the second number is the maximum for that tax rate and the first number in the next bracket is over the highest amount for the previous rate. Federal Income Tax Rates ; $19, - $81,, $9, - $40,, $14, - $54,, $9, - $40, ; $81, - $,, $40, - $86,, $54, - $86, NOTE: The % tax rate is the combined rate for Social Security and Medicare. This press release was produced and disseminated at U.S. taxpayer expense. Marginal tax rate: Your tax bracket explained ; Married Filing Jointly ; Income, Tax Bracket ; $22,, 10% ; $89,, 12% ; $,, 22%. The Illinois income tax rate is percent . Enter the amount of federally tax-exempt interest and dividend income reported on federal Form , U.S.

Most Popular Passive Income

Other passive income ideas for beginners · Create and sell an online course or e-book in an area of interest · Become an affiliate for products and make money. In popular culture, passive income refers to "easy money" that requires little work. Passive income is different from either a full-time job or a side gig. Some. Best passive income ideas for · Bonds and bond funds · High-yield savings account · Dividend stocks · Rental properties · Real estate investment trusts (REITs). People can create passive income streams by investing, selling online products, writing a blog, and more. "The Power of Passive Income" is an invaluable resource for anyone looking to break into the world of online earnings. It's a game-changer, demystifying the. Investing our hard-earned money in stocks, bonds, CDs, or savings accounts is a great way of earning some passive income. Passive income ideas · 1. Earn royalties on your photos or artwork. Licensing photos or artwork is one of the best examples of asset building. · 2. Design. 5 ways to earn passive income · 1. Sell your pictures to stock photo websites · 2. Rent out your car (to people or advertisers) · 3. Invest in dividend stocks · 4. Anyways Real Estate, Peer-to-Peer Lending, Dividend Stocks, Index Funds, Bonds and REITs are the best ways to create passive income. Thanks for. Other passive income ideas for beginners · Create and sell an online course or e-book in an area of interest · Become an affiliate for products and make money. In popular culture, passive income refers to "easy money" that requires little work. Passive income is different from either a full-time job or a side gig. Some. Best passive income ideas for · Bonds and bond funds · High-yield savings account · Dividend stocks · Rental properties · Real estate investment trusts (REITs). People can create passive income streams by investing, selling online products, writing a blog, and more. "The Power of Passive Income" is an invaluable resource for anyone looking to break into the world of online earnings. It's a game-changer, demystifying the. Investing our hard-earned money in stocks, bonds, CDs, or savings accounts is a great way of earning some passive income. Passive income ideas · 1. Earn royalties on your photos or artwork. Licensing photos or artwork is one of the best examples of asset building. · 2. Design. 5 ways to earn passive income · 1. Sell your pictures to stock photo websites · 2. Rent out your car (to people or advertisers) · 3. Invest in dividend stocks · 4. Anyways Real Estate, Peer-to-Peer Lending, Dividend Stocks, Index Funds, Bonds and REITs are the best ways to create passive income. Thanks for.

Online Business:Starting an online business, such as an e-commerce store or blog, can be a great way to earn passive income. While building an online business. One of the most popular passive income business ideas in the modern age is podcasting. Speak directly to your audience about topics important to you, and earn. People can create passive income streams by investing, selling online products, writing a blog, and more. SPI and Smart Passive Income is your home for community for entrepreneurs, offering expert advice, events, courses, and networking. Another popular passive income source is rental property. You might want to purchase a home to rent out to an ongoing tenant or list a property on a short-term. My investments will pay off down the line. And then the biggest caveat of all — most months I built an ongoing passive income stream. The book. In popular culture, passive income refers to "easy money" that requires little work. Passive income is different from either a full-time job or a side gig. Some. Dividend stock investment. Investing in dividend-paying stocks can be another lucrative passive income idea. Owning these stocks means you become a shareholder. A rental property is a good source of additional income, although it's one of the most passive sources of income because it will require time and some effort to. As you most likely know, this is one of my favorite ways to create passive income. YouTube pays creators for ad clicks that are driven by the creator's videos. Passive income is money you earn without actively working for it. Think of it as your money making more money on its own. For investors passive income is one of. Dividend (stock) investing is still the ranked the best passive income investment. However, it may not be the best for you given its higher volatility and lower. Dividend investing is a top passive income idea because it's low effort. You'll do some research up front to pick your stocks and then monitor them over time. 10 Best Passive Income Ideas: How to Make Money Online and Be Financially Free (chatgpt social media prompts | GumRoad | Internet Millionaires) eBook. There are several ways to invest in real estate passively. The most common way to do so is by investing in a real estate fund. Funds aggregate capital from an. Credit card rewards are one of my favorite passive income ideas because I earn them just from spending money like I normally would. In our house, this stream is. Have you found yourself trading more time and energy for monpey, rather than more money than time? This is a list of the best ways to make a passive income. Have you found yourself trading more time and energy for monpey, rather than more money than time? This is a list of the best ways to make a passive income. Individuals earn whatever the REIT pays as a dividend. The most popular REITs have a history of adding to their dividends by the year. REITs can provide a. Online Business:Starting an online business, such as an e-commerce store or blog, can be a great way to earn passive income. While building an online business.

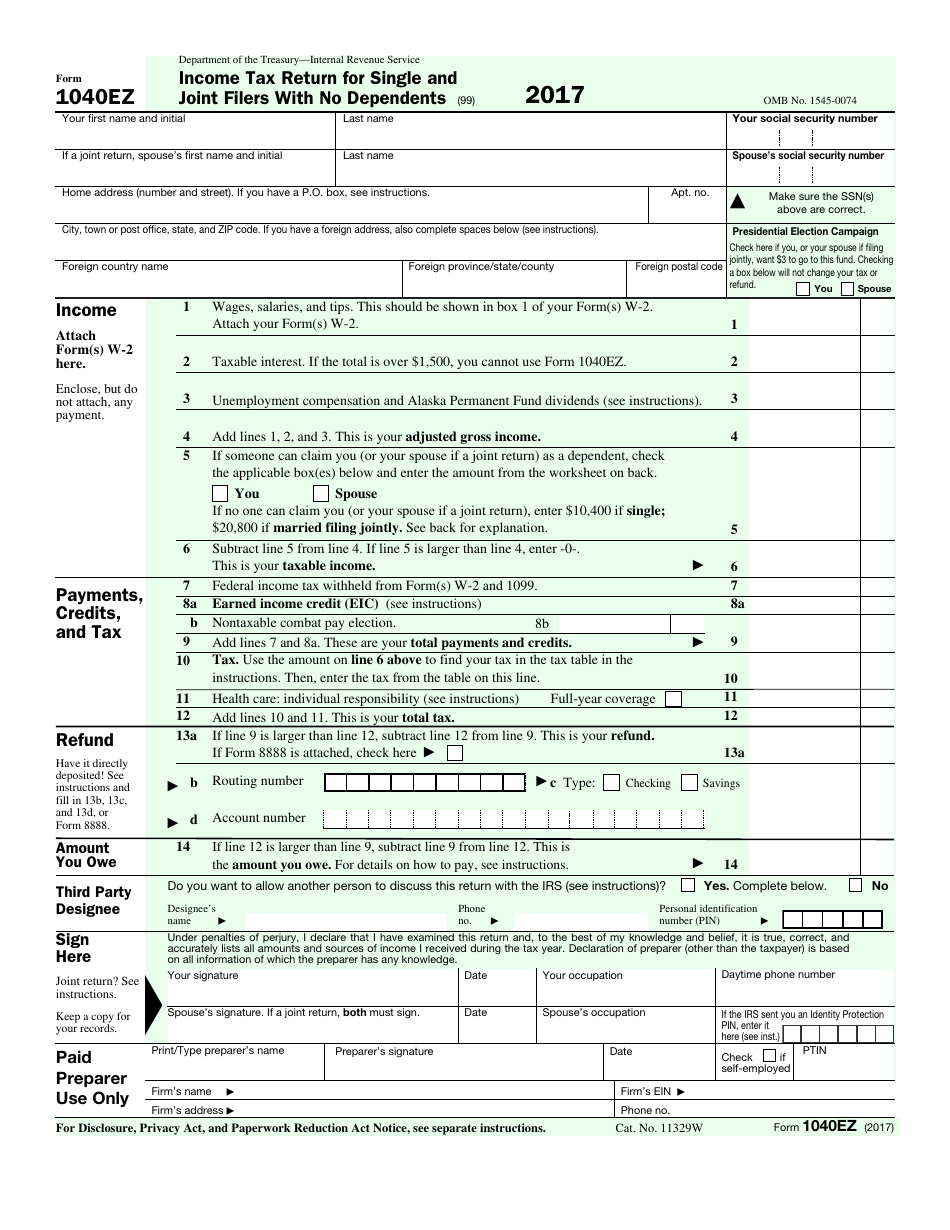

What Is Irs Form 1040ez

wikistreets.ru provides a FREE EZ tax form calculator and other EZ calculators to help individuals determine their tax situation for the coming year. Personal income tax return filed by full-year resident taxpayers. You may use Form EZ if all of the following apply. If you received a Form T or paid higher education expenses, you may be eligible for a tax credit or deduction that you must claim on Form A or Form. Simply select your tax filing status and enter a few other details to estimate your total taxes. Based on your projected tax withholding for the year, we then. Here are a few general guidelines on which form to use. EZ. Single or Married Filing Joint. Under age No dependents. Interest income is below $ Popular prior year forms, instructions and publications · Form () · Form () · Form () · Form MISC () · Form (). Form EZ, Income Tax Return for Single and Joint Filers with No Dependents, is a shorter and simpler version of the This form provides individuals with. Form EZ is a federal income tax form that was offered by the Internal Revenue Service (IRS) up through tax year Many American taxpayers used the form. The Form EZ no longer exists for use by taxpayers, but previous EZ filers may still qualify for a “simple return.”. wikistreets.ru provides a FREE EZ tax form calculator and other EZ calculators to help individuals determine their tax situation for the coming year. Personal income tax return filed by full-year resident taxpayers. You may use Form EZ if all of the following apply. If you received a Form T or paid higher education expenses, you may be eligible for a tax credit or deduction that you must claim on Form A or Form. Simply select your tax filing status and enter a few other details to estimate your total taxes. Based on your projected tax withholding for the year, we then. Here are a few general guidelines on which form to use. EZ. Single or Married Filing Joint. Under age No dependents. Interest income is below $ Popular prior year forms, instructions and publications · Form () · Form () · Form () · Form MISC () · Form (). Form EZ, Income Tax Return for Single and Joint Filers with No Dependents, is a shorter and simpler version of the This form provides individuals with. Form EZ is a federal income tax form that was offered by the Internal Revenue Service (IRS) up through tax year Many American taxpayers used the form. The Form EZ no longer exists for use by taxpayers, but previous EZ filers may still qualify for a “simple return.”.

The United States Internal Revenue Service (IRS) uses forms for taxpayers and tax-exempt organizations to report financial information, such as to report. IL Individual Income Tax Return · Did you know you can file this form online? · Footer. IRS Use Only—Do not write or staple in this space. Filing Status. Check only one box. Single. Married filing jointly. Married filing separately. The EZ form is the easiest of the three tax return forms (, A, EZ) is a simple 2-page form that you can fill out. In this guide to the EZ tax form, CPA Ted Kleinman will explain the key differences between the traditional , the A, and the EZ. If you received a Form T or paid higher education expenses, you may be eligible for a tax credit or deduction that you must claim on Form A or Form. Choose the Right Income Tax Form. Your residency status largely determines which form (paper or electronic) you will need to file for your personal income tax. A is a simplified version of the Form used to report your annual earnings and calculate federal taxes. This option will not electronically file your form. Income Tax Forms. Tax Year · Individual · Fiduciary, Estate & Trust · Partnership · Corporation · Tax. Individual Income Tax is due on all income earned by Kentucky residents and all income earned by nonresidents from Kentucky sources. Get federal tax return forms and file by mail. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Find. You can generally use Form EZ if: • Your taxable income is below $,;. • Your filing status is single or married filing jointly;. • You are. IRS Form EZ is a shortened version of the IRS tax Form ✓ easily fill out and sign forms ✓ download blank or editable online. Generally, you must file a Colorado individual income tax return if you are required to file a federal income tax return with the IRS for the tax year. If you make less than $K per year, don't have any dependents, and don't have a mortgage, then you're probably eligible to file the EZ. Here's why. This is an installment agreement request. It is used to ask the IRS to set up a monthly installment plan when a person is not able to submit the full amount of. IA Instructions · Common Forms · Applications & Other · Cigarette & Tobacco Tax · Corporation Income Tax · Fiduciary Tax · Franchise. Tax Forms. Instructions: Enter a full or partial form number or description into the 'Title or Number' box, optionally. Form ez is the simplest way to file your federal taxes. You do, however, need to meet certain eligibility requirements. Some of the major qualifications. IRS Tax Form Table Of Contents. Share Post. AccountingTaxes. March 4, Prior to the tax year, when you filed your personal income tax return.

Generating Passive Income Through Investments

One of the best ways to create passive income is to maximize your investments. Of course, this passive income strategy requires an upfront financial investment. Generating passive income usually requires upfront work, or sometimes a substantial investment to get the ball rolling. And depending on what your passive. Real estate investing. · Invest in art or alternative investments. · Sell designs or art online. · Investing in a high-yield savings account or certificate of. Investing in stocks is another popular way to create passive income. Dividend-paying stocks are stocks that pay you a percentage of the company's profits every. Today, my investments generate roughly $, in passive income. It's the As a 30 year-old, I already allocate roughly 50% of our household income into. Diversification. As part of a balanced portfolio, passive-income generating assets can provide stable growth alongside more volatile investments or assets that. Dividend investing. As a dividend investor, you purchase stocks that share earnings with shareholders by way of dividend payments. Dividend investing. Investing in rental properties is an excellent way to generate a steady passive income. As a property owner, you stand to gain from monthly rental payments and. Explore several ideas that can help generate passive income and grow your portfolio. · High-Yield Savings Account: Not glamorous, but it's low-risk. · Royalties. One of the best ways to create passive income is to maximize your investments. Of course, this passive income strategy requires an upfront financial investment. Generating passive income usually requires upfront work, or sometimes a substantial investment to get the ball rolling. And depending on what your passive. Real estate investing. · Invest in art or alternative investments. · Sell designs or art online. · Investing in a high-yield savings account or certificate of. Investing in stocks is another popular way to create passive income. Dividend-paying stocks are stocks that pay you a percentage of the company's profits every. Today, my investments generate roughly $, in passive income. It's the As a 30 year-old, I already allocate roughly 50% of our household income into. Diversification. As part of a balanced portfolio, passive-income generating assets can provide stable growth alongside more volatile investments or assets that. Dividend investing. As a dividend investor, you purchase stocks that share earnings with shareholders by way of dividend payments. Dividend investing. Investing in rental properties is an excellent way to generate a steady passive income. As a property owner, you stand to gain from monthly rental payments and. Explore several ideas that can help generate passive income and grow your portfolio. · High-Yield Savings Account: Not glamorous, but it's low-risk. · Royalties.

However, generating passive income from storing things for people requires a huge initial investment to acquire a storage structure. The alternative is. Making passive income through dividend stocks is an effective way to learn how to make money. You will earn income regularly by investing in mutual funds or. These investments range from traditional rental properties to more modern options like real estate crowdfunding and real estate investment. One way to generate passive income in real estate is to invest in the dividend-paying stocks of companies in the real estate industry. Real Estate Crowdfunding: Invest in real estate through crowdfunding platforms. You can buy shares in commercial or residential properties and. Rental Properties: One of the most popular strategies for generating passive income is rental properties. Investing in rental properties allows you to earn. REITs stand out as one of the ideal investments for passive income because they may allow you to earn a share of the income produced through commercial. Investment returns can be categorized into two main types: growth and income. Growth investments like stocks and private equity typically generate returns. Investing in dividend stocks, rental properties, or online businesses are popular for generating passive income. Understanding passive income tax rules is. To receive monthly passive income, consider dividend-paying stocks, REITs, or bond funds, as they often provide regular payouts. Money market. While your initial instinct might be to invest in physical real estate to generate investment income, that can come with a lot of headaches and more time. However, the only way to generate useable passive income is by building a taxable investment portfolio, which includes investing in real estate, alternative. For instance, if your commercial real estate investment generated $8, per year in cash flow, you could invest that capital into a high-yield portfolio. In. Dividend investing offers regular payouts to investors on their stocks' earnings. You can also invest in REITs, or real estate investment trusts, which buy. Creating passive income streams takes time, money or both. For instance, you could invest money into income-generating assets like dividend-paying stocks. How to earn passive income through stocks · 1. Dividend stocks · 2. Dividend index funds and exchange-traded funds · 3. Real estate investment trusts (REITs). Passive income is money that regularly goes into your bank account with little effort on your part, no matter how the market performs. Unlike growth investments. Earning passive income through investing in bonds/fixed income Governments, as well as companies, borrow money from investors. Those borrowings are known as '. Within this definition, you can also break passive income down into three categories: investing, asset building and asset sharing. investment trusts or money.

Can You Cash A Paycheck At Walmart

Walmart also does not cash personal checks. So what if you need to cash a personal check but don't have a bank account? Your best bet is to go to the financial. Payroll checks or your government benefits can be loaded directly onto a MoneyCard through direct deposit. This service is free, and you can opt to deposit all. Cash your checks or cards in any Walmart store. No registration is required, and you can get your cash immediately or, for extra convenience, load your money. Academy Bank lets you bank inside retailers, depositing cash into your checking account at the register with a cashier! Swipe and add cash today! You can order checks anywhere you choose. Our checks are convenient to order, meet all bank requirements, and are priced lower than typical bank pricing. In this article, I'll go over Walmart's check-cashing limits and their fees. Does Walmart cash checks? Yes, Walmart does check cashing. Many Walmart shoppers. At Walmart, you can cash various types of checks, including: It's important to note that personal checks are only accepted if they are pre-. You can add money to your card with cash or by cashing a check at any participating Walmart store. Reload and check cashing fees and limits may apply. Deposit checks in just a few clicks. Using your Walmart MoneyCard app you can deposit checks right from your mobile device. Walmart also does not cash personal checks. So what if you need to cash a personal check but don't have a bank account? Your best bet is to go to the financial. Payroll checks or your government benefits can be loaded directly onto a MoneyCard through direct deposit. This service is free, and you can opt to deposit all. Cash your checks or cards in any Walmart store. No registration is required, and you can get your cash immediately or, for extra convenience, load your money. Academy Bank lets you bank inside retailers, depositing cash into your checking account at the register with a cashier! Swipe and add cash today! You can order checks anywhere you choose. Our checks are convenient to order, meet all bank requirements, and are priced lower than typical bank pricing. In this article, I'll go over Walmart's check-cashing limits and their fees. Does Walmart cash checks? Yes, Walmart does check cashing. Many Walmart shoppers. At Walmart, you can cash various types of checks, including: It's important to note that personal checks are only accepted if they are pre-. You can add money to your card with cash or by cashing a check at any participating Walmart store. Reload and check cashing fees and limits may apply. Deposit checks in just a few clicks. Using your Walmart MoneyCard app you can deposit checks right from your mobile device.

My printer is a Brother model #MFC-JDW but I've been unable to find MICR for it. Please advise how I can print my checks so that they can be scanned for. Convenient, free cash reloads in Walmart/Sam's Club stores1 and other locations Security you can count on. Rest easy knowing your money is protected. No. Walmart will only accept a check made out to the person cashing it, and they must have a valid ID. Contributor Kathleen Garvin (@itskgarvin) is a personal. ACE can get you cash today! We even cash large and hard-to-cash checks.1 cash checks that other companies may not cash, and checks in any amount You may cash and deposit pre-printed payroll or government checks at Walmart. For information on cashing a check using the Ingo® Money App, depositing a. I signed up for direct deposit on March 9th say around pm. the woman in HR told all of us new employees we would receive our first check on the Answer. Can efs checks be cashed at Walmart??? Uh I doubt it Just curious, why on earth do you need to cash an EFS check at Walmart??? Those are typically. Walmart Cash is a promotional currency Walmart customers may receive pursuant to certain programs offered by Walmart. You can redeem your Walmart Cash and. CASH CHECKS AND GET YOUR MONEY IN MINUTES With the Ingo® Money App, cash paychecks, business checks, personal checks—almost any type of check—anytime. You will take home the value of the check, minus the fee. Some stores may require you to fill out a form. One of the main differences between using a bank and a. Besides your regular bank, you can cash checks at the issuing bank, a local grocery store, Walmart, and even your employer. Send cash reliably. Powered by Western Union, a name you know. How to purchase and use. During checkout, advise your Walmart cashier you would like to load cash into your checking account. Simply swipe or insert your debit card, hand the cash to. can guide you through the processes to complete a wide variety of financial transactions. you need, from reloading a debit card to getting new checks printed. You can deposit cash fee-free into your One Cash account at any Walmart cashier, Customer Service desk, or Money Center location in the United States. Get your paycheck up to 2 days early & unlock exclusive perks when you I can pop into Walmart for cash or make a deposit. I use it as my. Walmart charges a maximum fee of $4 to cash checks of up to $1, and a maximum fee of $8 for checks over $1, You can also deposit money to your bank debit. Cash it at the issuing bank (this is the bank name that is pre-printed on the check) · Cash a check at a retailer that cashes checks (discount department store. Can I cash a check at Walmart? Yes, you can cash a check at Walmart, but Walmart does have some check cashing fees, limits, and requirements you should be aware. you can get cash immediately with check cashing service You don't have to have an account with Regions to cash checks. Regions offers check cashing.

Invest In Cash Flow

:max_bytes(150000):strip_icc()/cashflowfinvestingactivities-recirc-8787bbde413f4036b2f8cfad5c4c6a99.png)

It is actually about a lot more than just cash flow. It provides readers with a basic grasp of how income property investments really work and serves as a. Cash flow, in general, refers to payments made into or out of a business, project, or financial product. It can also refer more specifically to a real or. With real estate investing, cash flow is the result of proceeds from rent payments. Let's take a multi-family apartment building as an example. Say the property. When purchasing rental properties with loans, cash flows need to be examined carefully. Rental property investment failures can be caused by unsustainable. Cash inflow is the money going into a business which could be from sales, investments, or financing. It's the opposite of cash outflow, which is the money. Cash flows from investing activities include making and collecting loans (except program loans; see Cash Flows from Operating Activities) and the acquisition. A cash flow asset is an investment that generates a steady and reliable stream of income over time. These assets aren't get-rich-quick avenues; they are for the. Cash-on-cash returns calculate the cash income earned over the cash you invested in a property. The formula to calculate a cash-on-cash return is (Annual Cash. Cash flow stems from operations, investing and financing activities, and normally moves from negative to positive as you grow past the startup phase. The cash. It is actually about a lot more than just cash flow. It provides readers with a basic grasp of how income property investments really work and serves as a. Cash flow, in general, refers to payments made into or out of a business, project, or financial product. It can also refer more specifically to a real or. With real estate investing, cash flow is the result of proceeds from rent payments. Let's take a multi-family apartment building as an example. Say the property. When purchasing rental properties with loans, cash flows need to be examined carefully. Rental property investment failures can be caused by unsustainable. Cash inflow is the money going into a business which could be from sales, investments, or financing. It's the opposite of cash outflow, which is the money. Cash flows from investing activities include making and collecting loans (except program loans; see Cash Flows from Operating Activities) and the acquisition. A cash flow asset is an investment that generates a steady and reliable stream of income over time. These assets aren't get-rich-quick avenues; they are for the. Cash-on-cash returns calculate the cash income earned over the cash you invested in a property. The formula to calculate a cash-on-cash return is (Annual Cash. Cash flow stems from operations, investing and financing activities, and normally moves from negative to positive as you grow past the startup phase. The cash.

Calculating your monthly cash flow will help you evaluate your present financial status, so you know where you stand financially as you prepare to invest. CASHFLOW Classic is the free online investing game that makes learning to invest fun. We believe the best way to learn isn't done reading textbooks or. Cash Flow From Op. Inv. & Fin. Activities. Net Income (Loss), $, $ Net Cash from Investing Activities, $(), $, $, $(), $ Cash flow management is tracking and controlling how much money comes in and out of a business in order to accurately forecast cash flow needs. Cash Flow from Investing Activities is the section of a company's cash flow statement that displays how much money has been used in (or generated from) making. If you're new to investing, you might be asking yourself how much you should invest, or if you even have enough money to invest. cash flow [or] excess money. Cash flow statements, on the other hand, provide a more straightforward report of the cash available. In other words, a company can appear profitable “on paper”. 1) Buy positive cash flow rentals · 2) Flip properties · 3) Charge a finder's fee on JV deals · 4) Offer a mortgage · 5) Become a mortgage agent · 6) Find deals for. Overview: Best investments in · 1. High-yield savings accounts · 2. Long-term certificates of deposit · 3. Long-term corporate bond funds · 4. Dividend stock. Investing cash flow describes the inflow or outflow of cash and cash equivalents resulting from investments in property, plant and equipment or financial assets. Real estate: Property investments are secure fixed assets capable of generating a monthly cash flow. · Vehicle rentals: Like properties, company vehicles can be. Certificates of deposit are a popular tool for investing the cash surpluses of a business. CDs are time deposits with banks and other financial institutions. Cash Flow from Investing Activities is a section of the cash flow statement that states the cash generated or expended through investment activities. Cash flow planning is essential: you need cash in the bank to pay your bills. Staying on top of your cash flow will help you see if you're going to run out. Cash is liquid money and is absolutely essential when you finance real estate. Cash is much easier to use if something goes wrong, whereas equity is completely. Investment properties can sometimes generate negative cash flow, which means you're required to put money in each year to cover the difference between the total. Presentation Objective. • This presentation is intended to provide a high level review of the economic structure of Private Equity (“PE”) fund investments. How to Find Positive Cash Flow Properties · 1. Choose Your Location Wisely · 2. Consider Community Context · 3. Find Off-Market Properties · 4. Focus On Cheaper. 4 Best Cash-Flowing Buys For — Buy For Less Than US$, To Earn More Than 10% Per Year · Price Is Vanity · Appreciation Is Sanity · Cash Flow Is King. Cash Flow Statement. The three major sections of a Cash Flow Statement are operating activities, investing activities, and financing activities. Cash from.

How Many Donations Can You Claim On Taxes

For tax years beginning in , an individual who does not itemize deductions may claim an above-the-line deduction in computing adjusted gross income (AGI) of. Requirements and limitations for charitable tax deductions · If you donate property to certain charitable organizations, your deduction might be limited to 50%. If you itemize deductions, gifts of cash to qualified public charities can be deducted in an amount up to 60% of your adjusted gross income (AGI) in a given. Time for a service donated doesn't qualify for tax deduction in However, you can deduct expenses related to volunteering, such as mileage driving to. contributions. For a description of the recordkeeping rules for substantiating gifts to charity, see Publication If you are filing your taxes, read. Are donations tax deductible? Yes, all tax deductible gifts over $2 to registered Deductible Gift Recipients (DGR) can be taken off your taxable income for. Noncash Charitable Contributions — applies to deduction claims totaling more than $ for all contributed items. If a donor is claiming over $5, in. As a result, the IRS continues to take a close look at such deductions. If you donated a car worth more than $, then you can only deduct the amount the. Part of figuring out if you should itemize is knowing how much your donations may be worth. The limit for cash donations is generally 60% of adjusted gross. For tax years beginning in , an individual who does not itemize deductions may claim an above-the-line deduction in computing adjusted gross income (AGI) of. Requirements and limitations for charitable tax deductions · If you donate property to certain charitable organizations, your deduction might be limited to 50%. If you itemize deductions, gifts of cash to qualified public charities can be deducted in an amount up to 60% of your adjusted gross income (AGI) in a given. Time for a service donated doesn't qualify for tax deduction in However, you can deduct expenses related to volunteering, such as mileage driving to. contributions. For a description of the recordkeeping rules for substantiating gifts to charity, see Publication If you are filing your taxes, read. Are donations tax deductible? Yes, all tax deductible gifts over $2 to registered Deductible Gift Recipients (DGR) can be taken off your taxable income for. Noncash Charitable Contributions — applies to deduction claims totaling more than $ for all contributed items. If a donor is claiming over $5, in. As a result, the IRS continues to take a close look at such deductions. If you donated a car worth more than $, then you can only deduct the amount the. Part of figuring out if you should itemize is knowing how much your donations may be worth. The limit for cash donations is generally 60% of adjusted gross.

If you itemize deductions on your federal tax return, you may be entitled to claim a charitable deduction for your Goodwill donations. According to the. In order to claim the deductions, you need to itemize deductions on your taxes instead of claiming the standard deduction If you choose to go this route, be. You can deduct charitable contributions made in cash for up to 60% of your adjusted gross income. You can also complete itemized deductions for donated items. For tax years beginning in , an individual who does not itemize deductions may claim an above-the-line deduction in computing adjusted gross income (AGI) of. When you donate cash an IRS-qualified (c)(3) public charity, you can generally deduct up to 60% of your adjusted gross income. Your deduction for charitable contributions generally can't be more than 60% of your adjusted gross income (AGI), but in some cases 20%, 30%, or 50% limits may. You can qualify for taking the charitable donation deduction without a receipt; however, you should provide a bank record (like a bank statement, credit card. If you make a total of more than $ worth of noncash gifts in a calendar year, you must file Form , Noncash Charitable Contributions, with your income tax. The donation cannot exceed 60% of your Adjusted Gross Income (AGI) in order to qualify as a tax deduction. For example, if you made $,, then you can. Part B income does not include dividends, capital gains, or interest (other than interest from MA banks). The charitable deduction is limited to 50% of the. According to the IRS, charitable cash contributions are typically limited to 60% of a taxpayer's adjusted gross income. Are donations worth claiming on taxes? It can be up to 30 percent of your adjusted gross income. Combine multi-year deductions into one year - Many taxpayers won't qualify for the necessary. If you itemize deductions on your federal tax return, you may be entitled to claim a charitable deduction for your Goodwill donations. How do tax deductions on donations work? Ah, the million-dollar question. When you make a charitable donation, you can deduct the value of your donation from. In order to claim the deductions, you need to itemize deductions on your taxes instead of claiming the standard deduction If you choose to go this route, be. If you want to take a charitable contribution deduction on your income-tax return, you need to substantiate your gifts. You must have the charity's written. For noncash gifts, the limit can range from % of your AGI, depending on the type of property you give and the type of charity organization you're donating. These increased limits, raised over the previous limit of 50%, is actually good news for charities. How to Maximize Your Tax Deduction Through Charitable Giving. Not all contributions are tax deductible. You can either ask to see the charity's IRS determination letter or review on the IRS's list of tax-exempt.

South African Advertisements

Google is the most used search engine in South Africa, accounting for an average of 95% of all organic traffic. This extensive reach means that ads placed on. Unilever margarine brand Rama used Facebook for the first time for a campaign to relaunch its brand in South Africa, and successfully increased ad recall by The top three MarkLives Ads of the Year are proof of this. We tip our hats to Gwijo Formations from Chicken Licken and Joe Public, Generating Gees from King. Are you a small, local, South African business selling innovative, locally-produced products? Ads. Ultimately, you get to control the cost of selling in the. Marketers are no longer reliant on only traditional media channels to communicate with consumers or customers. All advertisers have a range of established. Offer available only to advertisers which are new to Google Ads, with a billing address in South Africa. One promotional offer per advertiser. To activate. The following TV commercials that were broadcasted to the South African Audience were voted the best, based on the awards given to them by Loeries. Somalia; South Africa; Tanzania; Togo; Uganda; Zambia; Zimbabwe. Asia Pacific X may, during the course of a sensitive event, pause advertisements serving to. Make your own ad break. Rate commercials you love and hate. The best South Africa flavoured adverts as seen on TV and online. Over funny, retro. Google is the most used search engine in South Africa, accounting for an average of 95% of all organic traffic. This extensive reach means that ads placed on. Unilever margarine brand Rama used Facebook for the first time for a campaign to relaunch its brand in South Africa, and successfully increased ad recall by The top three MarkLives Ads of the Year are proof of this. We tip our hats to Gwijo Formations from Chicken Licken and Joe Public, Generating Gees from King. Are you a small, local, South African business selling innovative, locally-produced products? Ads. Ultimately, you get to control the cost of selling in the. Marketers are no longer reliant on only traditional media channels to communicate with consumers or customers. All advertisers have a range of established. Offer available only to advertisers which are new to Google Ads, with a billing address in South Africa. One promotional offer per advertiser. To activate. The following TV commercials that were broadcasted to the South African Audience were voted the best, based on the awards given to them by Loeries. Somalia; South Africa; Tanzania; Togo; Uganda; Zambia; Zimbabwe. Asia Pacific X may, during the course of a sensitive event, pause advertisements serving to. Make your own ad break. Rate commercials you love and hate. The best South Africa flavoured adverts as seen on TV and online. Over funny, retro.

In conclusion, Google Ads is an effective advertising platform that may assist South African companies in connecting with their target market and achieving. Somalia; South Africa; Tanzania; Togo; Uganda; Zambia; Zimbabwe. Asia Pacific X may, during the course of a sensitive event, pause advertisements serving to. Google is the most used search engine in South Africa, accounting for an average of 95% of all organic traffic. This extensive reach means that ads placed on. This South African road safety advert caused a % increase in seat belt usage. ads in NI: wikistreets.ru?v=o-Ai5AGLgLM. Browse and watch South African advertising works and commercials. AdsSpot is the largest archive of creative advertisements from South Africa. Semantic Scholar extracted view of "Black Like Me: Representations of Black women in advertisements placed in contemporary South African magazines. Shop wikistreets.ru for great deals on African Travel Ads (Vintage Art) Posters for sale South African Airways Poster. Art Print. 12 x 18 in. other sizes. $ The ARB administers the widely-accredited Code of Advertising Practice which regulates the content of South African advertising. The founding members of the ARB. Participants will not use celebrities or characters licensed from third-parties (such as cartoon characters) in television advertisements targeted at Children. South people killed in these situations are not protesting at all but simply running errands or completing africa chores—a africa documented repeatedly by. Free classifieds in South Africa. Vehicles, Vehicles , Cars, Spare Parts - Accessories, Audio and Video for Cars, Motorcycles – Scooters. South African Classic Adverts & Videos. likes · 9 talking about this. On this page we share memorable adverts and videos that either made us laugh. The adverts that really stick with us for years afterwards always manage to capture that special South African culture and spirit. One thing all South Africans. Australia (AU) · Egypt (EG) · Korea (KR) · Kuwait (KW) · New Zealand (NZ) · Qatar (QA) · Saudi Arabia (SA) · South Africa (ZA). (6) The advertisement must not imitate the general layout, text, slogans or visual presentation or devices of other advertisements from other companies in a. Imho when people in Europe think of starving African children Ghana isn't one to come to mind. (South) Sudan tho. Old South Flavor. As evident in the previous ads above, African Americans featured in advertisements were usually chocolate brown with short curly hair. Download this stock image: s advertisement for SOUTH AFRICAN AIRWAYS in British magazine dated March - E0HNXM from Alamy's library of millions of. Advertising policy. All advertisements and commercially sponsored publications are independent from editorial decisions. Editorial content is not. We rely on ads to keep creating quality content for you to enjoy for free. Please support our site by disabling your ad blocker. Disable. Continue without.

How To Buy Stock In Gamestop

Like other stocks, GME shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To. Is GameStop stock a Buy, Sell or Hold? GameStop stock has received a consensus rating of sell. The average rating score is and is based on 0 buy ratings. How to Buy Gamestop Stock · Step 1: Figure out where to buy Gamestop stock · Step 2: Open your brokerage account · Step 3: Deposit money your brokerage account. The Redditors get more people on board with their plan, and GameStop stock starts flying up. Buy Gift Cards · Ways to Watch · Terms of Use · Privacy; Cookie. Buy directly on Computershare, the official transfer agent for GameStop. Important information about buying Gamestop stock including DRS statement, timing, display certificates and more. Sign up for a Robinhood brokerage account to buy or sell GameStop stock and options commission-free. Other fees may apply. See Robinhood Financial's fee. Given the current short-term trend, the stock is expected to fall % during the next 3 months and, with a 90% probability hold a price between $ and. Firstly, they can buy shares in companies on the exchanges where they are listed. For instance, you can buy GameStop stock on the NASDAQ exchange, so you own a. Like other stocks, GME shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To. Is GameStop stock a Buy, Sell or Hold? GameStop stock has received a consensus rating of sell. The average rating score is and is based on 0 buy ratings. How to Buy Gamestop Stock · Step 1: Figure out where to buy Gamestop stock · Step 2: Open your brokerage account · Step 3: Deposit money your brokerage account. The Redditors get more people on board with their plan, and GameStop stock starts flying up. Buy Gift Cards · Ways to Watch · Terms of Use · Privacy; Cookie. Buy directly on Computershare, the official transfer agent for GameStop. Important information about buying Gamestop stock including DRS statement, timing, display certificates and more. Sign up for a Robinhood brokerage account to buy or sell GameStop stock and options commission-free. Other fees may apply. See Robinhood Financial's fee. Given the current short-term trend, the stock is expected to fall % during the next 3 months and, with a 90% probability hold a price between $ and. Firstly, they can buy shares in companies on the exchanges where they are listed. For instance, you can buy GameStop stock on the NASDAQ exchange, so you own a.

Buy directly on Computershare, the official transfer agent for GameStop.

GameStop stock research in summary GameStop shares are more expensive than other comparable stocks. They are riskily financed, are poor value, and show below. The first step in buying GameStop shares is you need to find a great stockbroker you can easily buy the GameStop shares from them. In the world. NFT ETFs invest in companies that work with NFTs, crypto, and blockchain technology. What Is Buying to Cover? Timothy Green | Dec 4, View More GME. To buy fractional shares of GameStop Corp stock, you'll need to sign up for Stash and open a personal portfolio. Stash allows you to purchase smaller pieces of. To purchase GME stock, one simply has to open and fund an account with a brokerage that offers access to the New York Stock Exchange. Is it Smart to Buy GME. How to Buy Gamestop Stock · Step 1: Figure out where to buy Gamestop stock · Step 2: Open your brokerage account · Step 3: Deposit money your brokerage account. RoaringKitty (aka, Keith Gill) started sharing his views about GameStop stock What Is Preferred Stock and Should I Buy It? A common stock certificate. The most straightforward way is to find a reliable centralized exchange where you can buy GameStop, similar to Binance. You can refer to wikistreets.ru's. Shop GameStop, the world's largest retail gaming and trade-in destination for Xbox, PlayStation, and Nintendo games, systems, consoles & accessories. The bid & ask refers to the price that an investor is willing to buy or sell a stock. The bid is the highest amount that a buyer is currently willing to pay. On eToro, you can buy $GME or other stocks and pay ZERO commission! Follow GameStop Corp. share price and get more information. Terms apply. Invest in GameStop, NYSE: GME Stock - View real-time GME price charts. Online commission-free investing in GameStop: buy or sell GameStop Stock. What's Going On With GameStop Stock? Sep. 3, at p.m. ET on Benzinga Best Buy Co. Inc. %, $B. HHGregg Inc. %. Advertisement. Most basic rule of stocks; buy low, sell high. Right now, GameStop stock is very, very high. The potential to make money is limited, the. Overall, GameStop Corp stock has a Growth Grade of D, Quality Grade of B, Momentum Grade of B. Whether or not you should buy GameStop Corp stock will. Buy or sell recommendation and investment advice on GameStop Corp for September. Macroaxis investing advice on GameStop Corp is currently Strong Sell. One Share of GameStop. (Stock Symbol: GME) is a Truly Unique Gift. Birthday, Baptism, Christening, Anniversary, Newborn, Groomsmen gifts and more. The Fund Sentiment Score (fka Ownership Accumulation Score) finds the stocks that are being most bought by funds. It is the result of a sophisticated, multi-. One Share of GameStop. (Stock Symbol: GME) is a Truly Unique Gift. Birthday, Baptism, Christening, Anniversary, Newborn, Groomsmen gifts and more. Approximately percent of GameStop's public float had been sold short, and the rush to buy shares to cover those positions as the price rose caused it to.

Best Air Fryer For 2 Adults

If you want to cook for more than four people – or you just have a particularly hungry household – air fryers such as the Tefal Actifry 2 in 1 can fit almost. Small. Suggested portions: Great for making a few portions of chips. Shop small air fryers. With an 8-quart capacity that's split across two drawers, this Instant Vortex Plus Dual Basket Air Fryer is perfect for families and those who want to cook a. We're very happy with our new air fryer. Holds enough for most dishes and feeds 2 adults easily. Really convenient size, considering our previous unit was. Best air-fryer overall: Ninja Double Stack XL SLUK, £ · Best single-drawer air-fryer: Cosori TurboBlaze, £ · Best dual-drawer air-fryer: Ninja Foodi. The Ninja AF Air Fryer boasts an impressive set of features that make it stand out as one of the best air fryers. This versatile appliance. Breville Smart Fryer: This compact fryer took a long time to heat up, and then our external thermometer's temperature careened upwards, as the fryer heated to. Air fry. Bake. Toast. Roast. Reheat. Broil and preheat in less than two and a half minutes. For Small Kitchens or Servings ( people): these qt size fryers are a great size to cook about 2 servings of chicken or fish with a few veggies on the. If you want to cook for more than four people – or you just have a particularly hungry household – air fryers such as the Tefal Actifry 2 in 1 can fit almost. Small. Suggested portions: Great for making a few portions of chips. Shop small air fryers. With an 8-quart capacity that's split across two drawers, this Instant Vortex Plus Dual Basket Air Fryer is perfect for families and those who want to cook a. We're very happy with our new air fryer. Holds enough for most dishes and feeds 2 adults easily. Really convenient size, considering our previous unit was. Best air-fryer overall: Ninja Double Stack XL SLUK, £ · Best single-drawer air-fryer: Cosori TurboBlaze, £ · Best dual-drawer air-fryer: Ninja Foodi. The Ninja AF Air Fryer boasts an impressive set of features that make it stand out as one of the best air fryers. This versatile appliance. Breville Smart Fryer: This compact fryer took a long time to heat up, and then our external thermometer's temperature careened upwards, as the fryer heated to. Air fry. Bake. Toast. Roast. Reheat. Broil and preheat in less than two and a half minutes. For Small Kitchens or Servings ( people): these qt size fryers are a great size to cook about 2 servings of chicken or fish with a few veggies on the.

2–4 servings (perfect for our household of 2 adults and 2 small kids) 1x. Print Recipe. Pin Recipe. Description. My go-to everyday air fryer chicken breast! Browse and shop Macys for a large selection of Countertop Air Fryer. Choose from a variety of models and find your ideal one now. FREE SHIPPING available! Whether we wanted to cook one or four burgers, or two burgers and a serving of french fries, the FlexBasket design let us do that. The large basket has a. Ninja AF Air Fryer that Crisps, Roasts, Reheats, & Dehydrates, for Quick, Easy Meals, 4 Quart Capacity, & High Gloss Finish, Grey. The Ninja AF Air Fryer stands above other models as the best air fryer for 2 people in With its 4-quart basket capacity and ” footprint. However, if you cook for two and want to frequently, say, cook a protein and vegetable at two different temperatures at once, opt for the Instant Vortex Plus. BEST AIR FRYER FOR FAMILIES: Ninja XXXL Flex Drawer Air Fryer – $ (down from $) from The Good Guys. This family size friendly Ninja air fryer is one of. First off the recipe book that comes with this Cosori Pro II Quart Smart Air Fryer is so FULL of great ideas that give you the exact amount of food, the. Golden brown homemade air fryer French fries are simply the best. You won't believe how crispy and flavorful they are, with hardly any oil! Customers recognize the Foodi 6-in-1 Air Fryer for its user-friendly design, dual baskets, and DualZone technology that enhances cooking efficiency. They. Last but surely not least, the Ninja DZ Foodi DualZone Air Fryer can be your go-to choice if you love making two different dishes of snacks. Cauliflower cheese: Small cauli halved and cooked with 2 tbs water in glass bowl in microwave with plate on top. Drained then topped with. You'll love these easy and healthy air fryer recipes! From air fryer salmon to crispy chicken tenders, and the best air fryer baked potato recipe. The slide out trays give plenty of room to make a meal for 2 adults and 2 growing boys. And they love the air fried food better than greasy traditional frying. Ninja's Foodi MAX Dual Zone L Air Fryer (AFUK) has a large capacity and 2 separate cooking zones that can fit a 2kg chicken in each drawer. Best Air Fryer for a Family. Enjoy fried foods at home without all the It makes enough for 2 adults but I need to plan to run it twice to feed my. Best air fryer brands in Australia. 1. Ninja. 2. Kmart. 3. Philips. 4. Sunbeam. 5. Kogan. 6. Breville. 7. Mistral. 8. DeLonghi. 9. Ambiano (ALDI). Tefal. Bottom line: Air fryers create the crispy, chewy foods people love without all the oil. What Can You Cook in an Air Fryer? An air fryer can cook pretty much. Customers recognize the Foodi 6-in-1 Air Fryer for its user-friendly design, dual baskets, and DualZone technology that enhances cooking efficiency. They. Tefal EYD40 Easy Fry Dual Zone Air Fryer & Grill, L, Stainless Steel Product review details, this product has received, on average, out of 5 star.